Blogs

INDUSTRY INSIGHTS

By Baden Tax Management

•

July 7, 2025

As the fourth quarter begins, tax departments face compounding variables: compressed timeframes, resource constraints, and rapidly shifting state-by-state regulations. In this setting, any weakness in tax provider performance becomes amplified. Disjointed communication, inconsistent data review, or jurisdictional overs

May 15, 2025

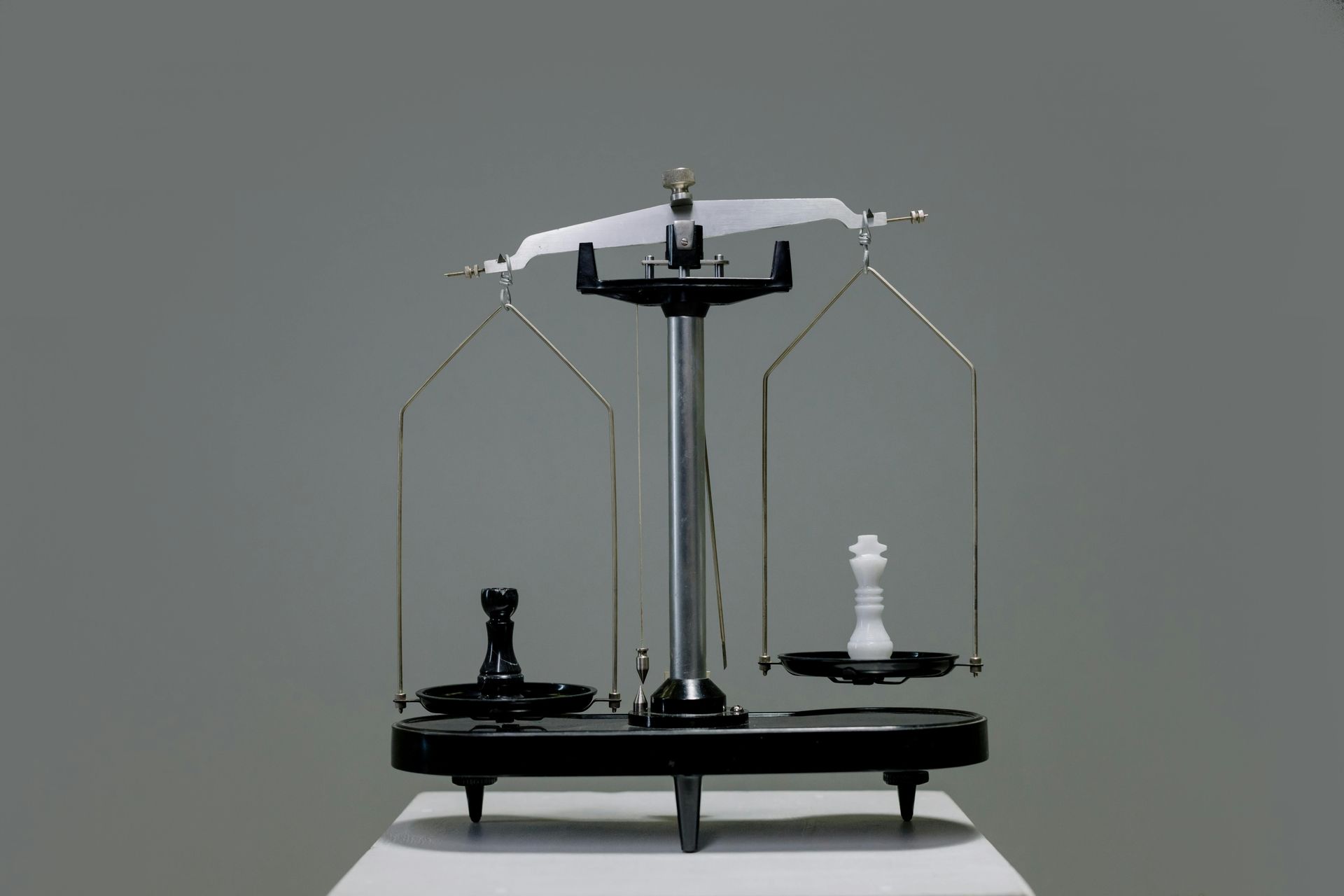

Is Your PROPERTY Tax Provider Just Checking Boxes? 5 SIGNS IT'S TIME TO TAKE A CLOSER LOOK Many companies stick with their property tax compliance provider out of habit—or the fear that switching will be more painful than staying put. But when that provider is underperforming, the hidden costs can be significant: missed deadlines , overpayments , audit exposure , and unnecessary internal workload . At Baden, we’ve reviewed hundreds of compliance setups. What we consistently find is this: by the time companies call us, they’ve already been absorbing risk and leaving savings on the table for years. Here are five red flags that it might be time to re-evaluate your current provider—before problems get worse. 1. Deadlines Keep Slipping (AND YOU'RE THE ONE LOSING SLEEP) Late or rushed filings shouldn’t be business as usual. If you’re constantly nudging your provider for updates or scrambling to respond to urgent requests, that’s not a partnership—it’s a liability. The Risk : Missed deadlines mean penalties, unnecessary scrutiny, and fire drills that sap your team’s time and confidence. 2. You're Doing More Work Than They Are Outsourcing is supposed to free up your internal resources. But when you’re chasing down tax detail, hunting for data, or second-guessing reports, the burden shifts back to you. The Risk : Your team loses hours (and morale) while still being exposed to compliance errors they didn't create. 3. YOU HAVE NO ACCESS TO SENIOR EXPERTISE If you haven’t heard from a senior advisor since the sales pitch, you’re likely missing critical insights. Complex operations demand more than junior-level processing—they require experienced professionals who can anticipate challenges, explain nuances, and optimize your tax position. The Risk : Strategic savings opportunities go unnoticed, and you're left reacting instead of planning. 4. COMMUNICATION IS SLOW, VAGUE OR GENERIC Waiting days for vague answers—or feeling like you're working through a help desk—doesn’t cut it. Your tax partner should speak your language, understand your operations, and communicate proactively. The Risk: Poor communication delays decisions, introduces errors, and erodes trust in the entire compliance process. 5. THERE'S NO CLEAR ROI When was the last time your provider showed you a year-over-year savings trend? Have they ever brought new ideas or flagged overpayments before you did? The Risk: Without transparency and initiative, you could be overpaying every year—and never know it. NEED A SECOND SET OF EYES? We’re offering a free, no-obligation review of your current compliance setup. Baden’s team will: Evaluate your current process for risk, redundancy, and reporting gaps Identify areas where savings may be slipping through the cracks Share a candid, senior-level perspective on how your compliance setup compares to industry best practices This isn’t a sales pitch—it’s a strategic gut-check from a team that works on your side of the table. Let’s talk . Schedule Your Free Compliance Review

May 5, 2025

Discover the overlooked charges that may be inflating your tax bill Many manufacturers unknowingly overpay millions in personal property taxes every year. The problem? Missed savings opportunities related to asset classifications, missed exemptions, and a lack of creative tax reduction strategies that impact your bottom line. At Baden Tax , we specialize in helping manufacturers identify tax savings and optimize compliance. This blog outlines the top reasons businesses overpay and how to ensure you are only paying what is necessary. 1. Misclassified Assets Are Costing You Thousands One of the most common tax mistakes is incorrectly classifying assets, which can significantly impact values and tax liabilities. Is it real or personal property? The answer is not always as simple as it seems. Misclassification can result in double assessment OR exposure. Depending on the state, various types of assets qualify for exemption, deductions, or special treatment that can significantly reduce your tax. Upgrades, rebuilds, and repairs present a special opportunity for tax savings that many taxpayers overlook. Large asset capitalizations often contain embedded components such as software, tooling, or intangible costs that are either exempt or subject to lower assessment. Highly specialized equipment often qualifies for special assessment treatment that can substantially reduce your tax liability. What to do next: Conduct a thorough asset classification review to ensure everything is categorized correctly. 2. Missing Key Tax Exemptions and Incentives Many manufacturers qualify for state and local tax exemptions, but most do not take full advantage of them. Specific machinery and equipment may qualify for exemptions. Many companies can benefit from economic development incentives, but never apply for them. What to do next: Work with a tax expert who understands your industry and location to uncover potential exemptions. 3. Inaccurate Property Tax Assessments Are you confident your property tax assessment accurately reflects your assets' fair market value? If your assessed values are too high, you may be paying more than necessary. Signs your property tax assessment might be inaccurate: You have never appealed your property tax assessment. Your tax bill has increased significantly without explanation. You have never considered functional or economic obsolescence with your property tax filings. What to do next: Request a tax savings assessment to analyze whether your assets are overvalued 4. Failing to Conduct a Tax Savings Assessment Many manufacturers assume that they cannot recover overpayments once they have paid taxes. A tax exposure assessment can uncover prior tax overpayments, often leading to significant refunds. Reviewing historical tax filings can reveal classification errors that resulted in overpayment. Identifying missed deductions can help reduce future liabilities. Reassessing past property tax bills may uncover opportunities for refunds. What to do next: An assessment can help identify refund opportunities and reduce future liabilities. 5. Sticking with the Wrong Property Tax Provider If your tax provider is not proactively helping you reduce property tax liability, you could leave money on the table. Many companies stay with the same provider for years without questioning whether they get the best service. Questions to ask yourself: Is my tax provider helping me find savings or just filing paperwork? Have I compared my tax costs to industry benchmarks? When was the last time I reviewed my provider’s performance? What to do next: Compare providers and consider an expert consultation to see if you could be saving more. How Much Are You Overpaying? Find Out Today If you are unsure whether you are paying too much in personal property tax, now is the time to act. A simple review could uncover hidden savings opportunities that significantly impact your bottom line. Request a Free Tax Savings Assessment

GET IN TOUCH

Let’s Unlock Savings Together

Take the first step toward reducing your tax burden and gaining peace of mind. Contact us today to start your tailored solution.

Blog Contact Form

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.